when are property taxes due in kane county illinois

719 S Batavia AveThe Kane County Assessors Office is located in Geneva Illinois. Property taxes come due in june and september every year but the proposal if passed as a bill by the state legislature would allow taxpayers to forego interest and late penalties on their june.

Homes For Rent In Kane And Mchenry County In 2022 Renting A House Real Estate News Algonquin

6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk Theresa Barreiro Phone.

. Kane County Treasurer Michael J. Communities Consumers Education Events Government Homeowners Kane County Kane County Treasurers Office Taxpayers. 6302323565 KilbourneMichaelcokaneilus Website Kane County Clerk John Cun ningham Phone.

The requested tax bill for tax year 2021 has not been prepared yet. A property must be the principal residence of the owner for the beginning of two consecutive years and the owner must be 65 or older by December 31 of the tax assessment year and meet certain household income requirements. If you disagree with the countys conclusion you can appeal to a state board or panel.

The break will not apply to payments done through a third. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. The Kane County Board approved a plan to ensure no one pays late fees on payments due June 1 as long as they are turned in by July 1.

29 Deadline To Pay. Property taxes are developed from two components. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30. Kane County Treasurer 719 S. Simply put the Illinois property tax system divides up each.

On Unpaid Kane County Property Taxes Now Considered Delinquent Jan. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. 20 - 423-429 E CHICAGO STREET CONDO.

Kane County collects on average 209 of a propertys assessed fair market value as property tax. Kanecountyconnects January 20 2021 Comments Off. 6302323413 BarreiroTheresacokaneilus W ebsite.

Where Can I Pay My Property Taxes In Kane County. Under Illinois law property taxes are the primary means of funding local governments. The first installment will be due on or before June 1 2021 and the second installment will.

The exact property tax levied depends on the county in Illinois the property is located in. 3164 - COURTYARDS OF. KANE COUNTY TREASURER Michael J.

Because if your payment doesnt reach by the due date then your tax will become delinquent and you will be charged a. Property taxes are paid at the Kane County Treasurers office located at 719 S. The Kane County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Kane County Illinois.

In most counties property taxes are paid in two installments usually June 1 and September 1. Making sure my real estate taxes are paid can be difficult. The county collector is charged by the county clerk to collect all of the taxes levied by approximately 270 local taxing bodies within kane county.

The first installment will be due on or before June 1 2021 and the second installment will be due on or before Sept. That updated market value is then taken times a composite rate from all taxing entities together to calculate tax assessments. 630-208-7549 Office Hours Monday Thru Friday.

If you have to go to court you better solicit for help from one of the best property tax attorneys in Kane County IL. Cook County and some other counties use this. Payments made online can take up to 72 hours to receive in Treasurers office.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value. You can contact the Kane County Assessor for.

3315 - BUONA ST. 3317 - COURTYARDS OF ST. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value.

Geneva is the county seat of Kane County where most local government. Those entities include Kane the county districts and special purpose units that make up that total tax levy. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

The Kane County Government Center in Geneva features a 24-hour drive up drop-off location along Building A where many banks within Kane County and the Kane County Treasurers Office conduct business over the Internet by credit card or even in person at one. Kane County Treasurer Michael Kilbourne. An assessor from the countys office determines your real estates value.

Bldg A Geneva IL 60134 Phone. Tax Bill Is Not Ready. Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30.

The taxes levied by each local government tax-ing district and the relative value of each taxable parcel in the boundaries of each taxing district. So if you pay on the due date your payment must reach 1200 pm. The Will County Board has not made any decisions on whether the property tax payment deadline of June 3 will be pushed back or if interest and fees will be waived.

CHARLES OFFICE CONDO AMEND PER 2015K018901. Batavia Avenue Geneva ILYou may call them at 630-232-3565 or visit their website at. Protesting your propertys tax value is your right.

Kane County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. County boards may adopt an accelerated billing method by resolution or ordinance. Once taxes for the selected year have been extended the tax bill will be available.

Kane County Property Tax Inquiry.

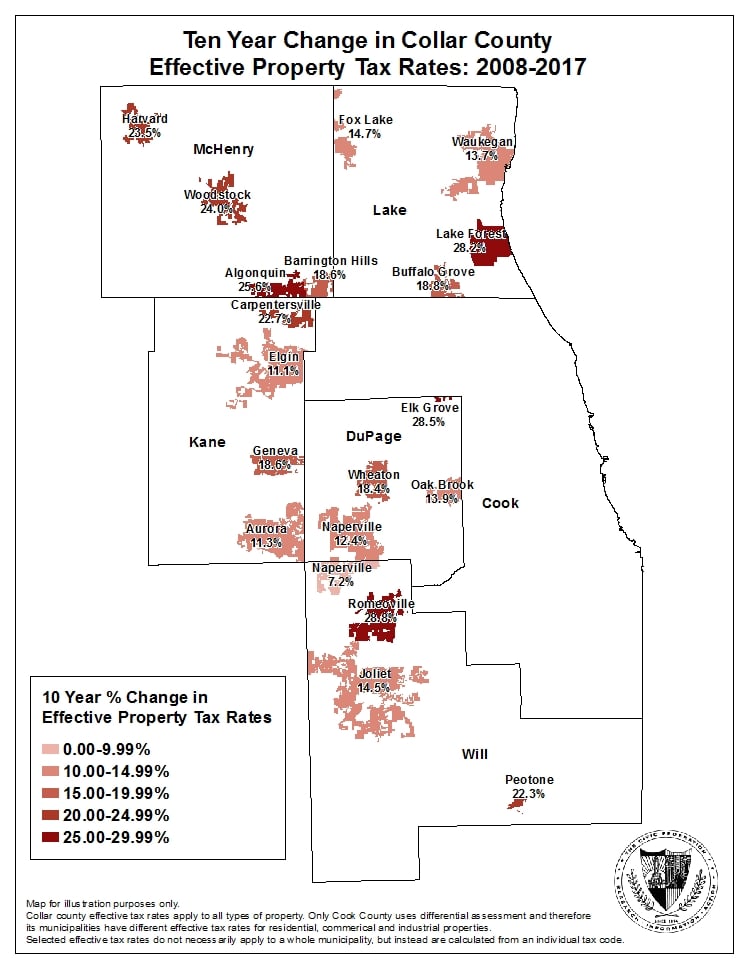

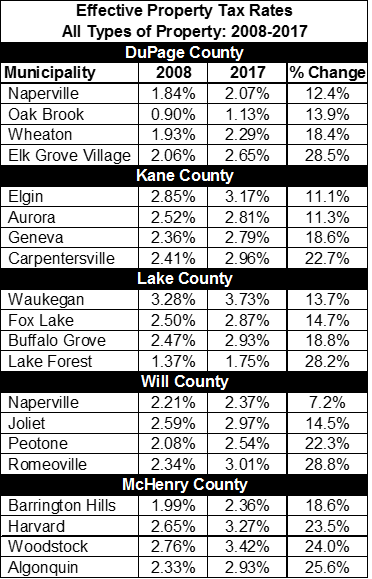

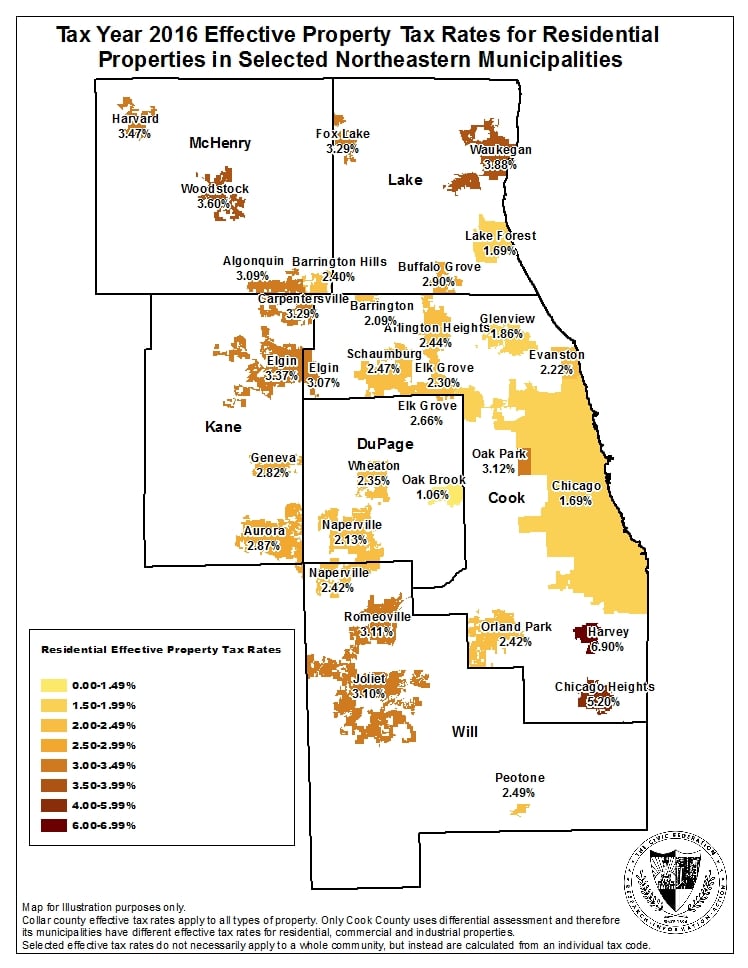

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

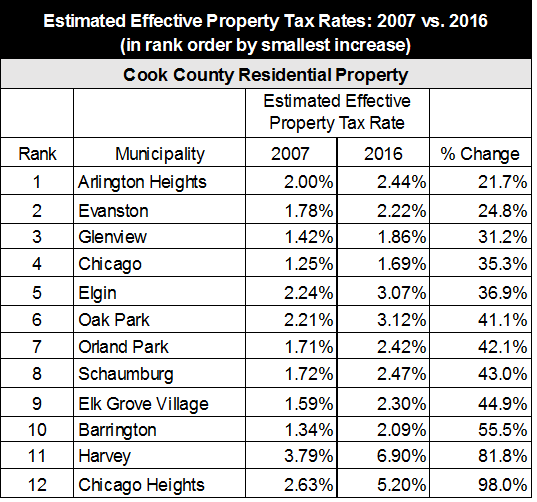

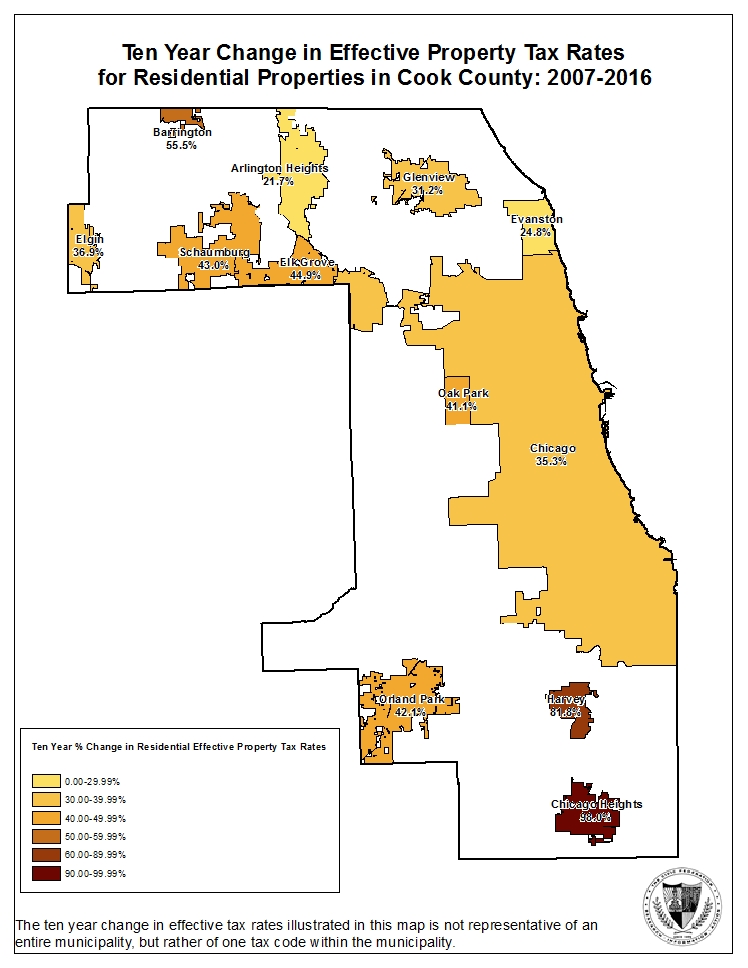

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

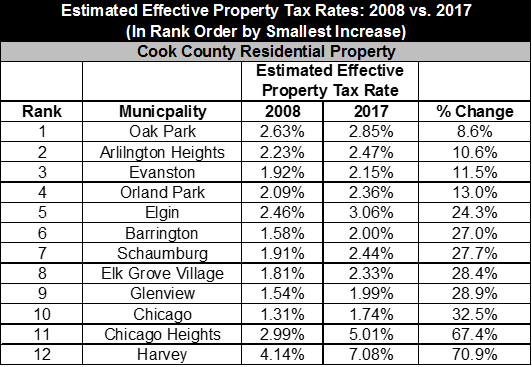

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Real Estate News

Why Illinois Property Taxes Are Higher Than Your Mortgage Youtube

Kane County Waives 30 Day Property Tax Payment Penalty Kane County Connects

Illinois Budget Includes 1 Billion In One Time Relief For Grocery Gas Some Property Taxes Kane County Connects

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Illinois Property Taxes Kane County Offers Some Relief Will County Residents Still Wondering Abc7 Chicago

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

How To Appeal Property Taxes In Geneva Il Beautiful Places Valley View Forest Preserve

Cook County Il Property Tax Search And Records Propertyshark

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan

Deadline Approaching For Seniors To Apply For Property Tax Deferral Program Kane County Connects

Estimated Effective Property Tax Rates 2007 2016 Selected Municipalities In Northeastern Illinois The Civic Federation

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation